EE found to be dodging tax

EE, the network bringing 4G LTE to the UK and the parent company of Orange and T-Mobile, have been shown to be avoiding untold billions in tax. They join Vodafone and LycaMobile amongst the shamed ranks of companies avoiding their tax liabilities.

EE, the network bringing 4G LTE to the UK and the parent company of Orange and T-Mobile, have been shown to be avoiding untold billions in tax. They join Vodafone and LycaMobile amongst the shamed ranks of companies avoiding their tax liabilities.

EE’s latest accounts show that it has not paid anything at all in corporation tax in the UK. It is thought that the company is manipulating accounts so it technically makes a loss in the UK and can avoid paying taxes. This is despite the company spending millions for the spectrum required to provide 4G services and annual sales of £6.8 billion in 2011. Vodafone have been reported to be dodging £6 billion of UK taxes but it’s not clear exactly how much EE should be paying.

The revelations come as the debate about mega corporations failing to pay tax in the UK hits a peak. Activist group UK Uncut points out that people are told they must pay their taxes and that there’s no alternative to the ideological cuts to public services. Corporate tax dodging is thought to cost the state almost £100 billion per year yet, thanks to the Coalition’s crippling cuts and normal people are suffering while HMRC allows companies like EE and Vodafone to avoid paying taxes.

EE may legally be allowed to make use of this loophole while it lasts, but the British public are getting impatient will morally dubious tactics like this.

What’s your take? What do you think of EE not paying any corporation tax? Are they greedy thieves or smart? Do mobile companies have a social obligation to pay a fair rate of tax? And do you think the government should do more about it?

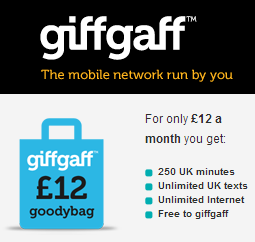

At the beginning of the month, budget mobile network Giffgaff implemented their latest price restructuring. After an

At the beginning of the month, budget mobile network Giffgaff implemented their latest price restructuring. After an

Recent Comments